Lots going on in the world right now, but still lots to be thankful for this Thanksgiving weekend! A buyer of real estate right now has more choice with some deals to be had while sellers need to make sure they are astute in how, and who with, they list their home for sale. Some communities and towns outside of Calgary are doing well and will fare much better than others in the coming year ahead. Previous peaks where 2007 and 2014 for Calgary. I have started a new brokerage to meet the future challenges for buyers and sellers. A new web site is coming soon!

August 2025 real estate sales cool off which is typical for this time of year

August sales cooled off which is typical for the dog days of summer. Sales of apartments and row housing dropped the most as a flood of new inventory has entered the market. Net migration is down especially from the eastern Canada where real estate sales and pricing is in a bit of a free fall, especially in the greater Ontario region. Overall, Alberta is doing well compared to the rest of Canada as the impact of the USA tariffs are not hitting us as hard due to the American’s needing our energy. Our farming communities may be hit hard with market access this fall. We will have to wait and see what happens on that front. Of all the areas, Okotoks is doing better than almost all other regions in southern Alberta.

Real Estate market in Calgary and area is shifting.

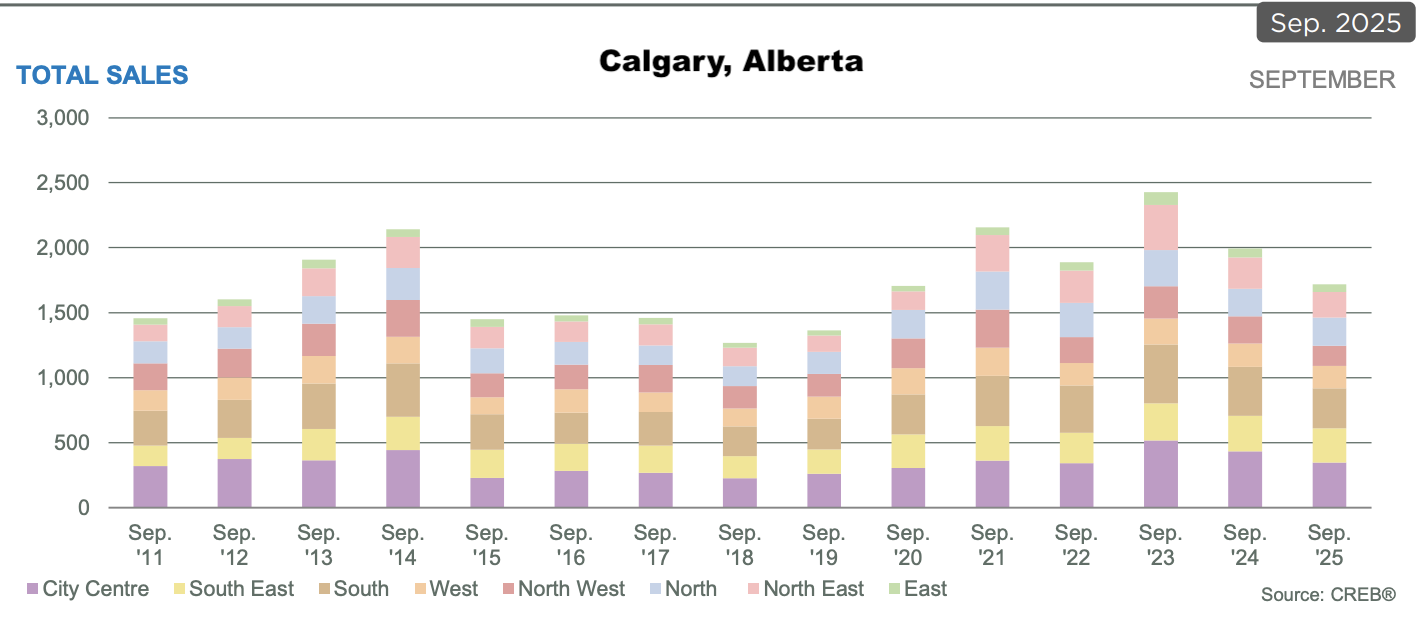

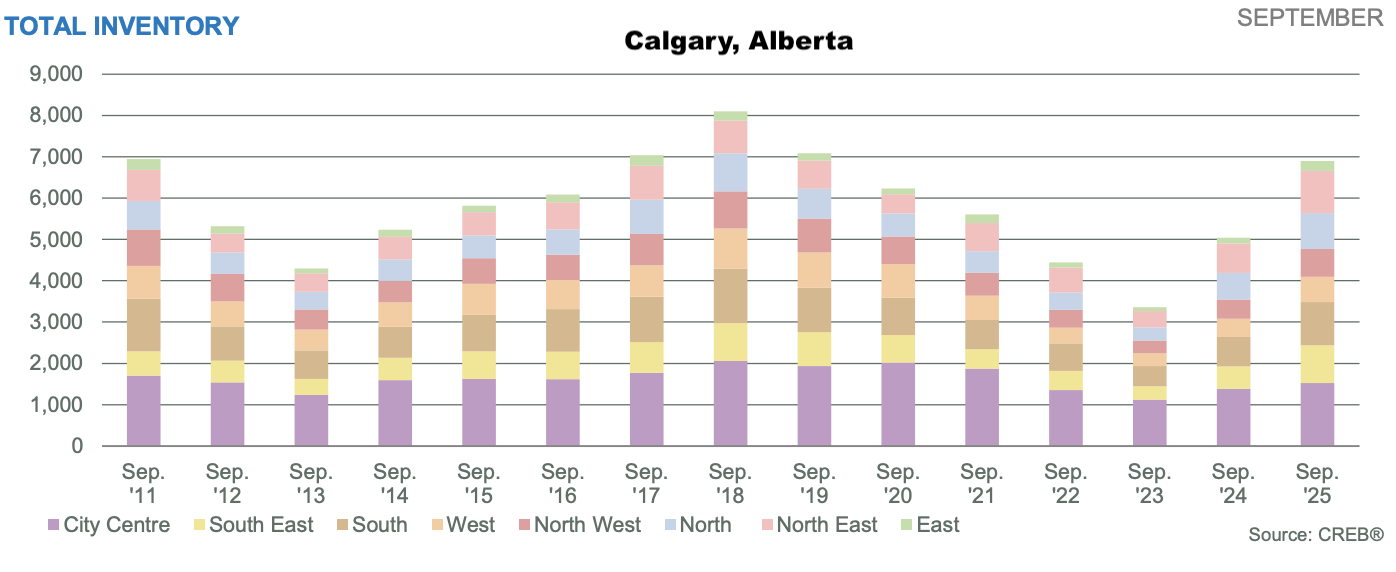

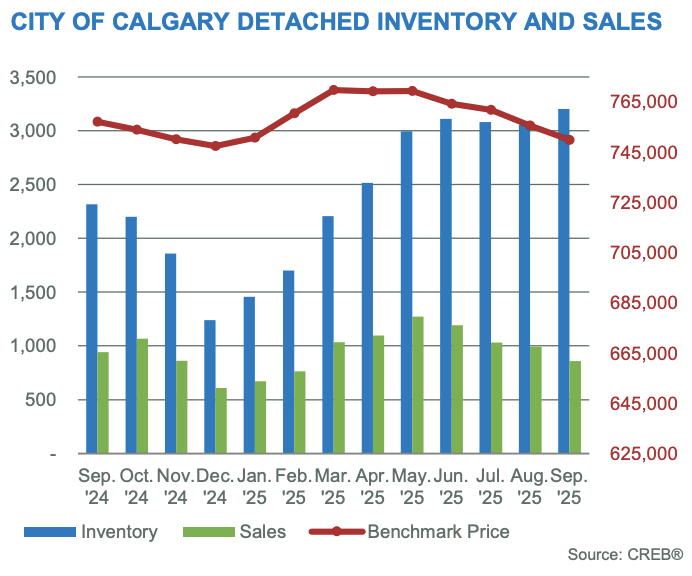

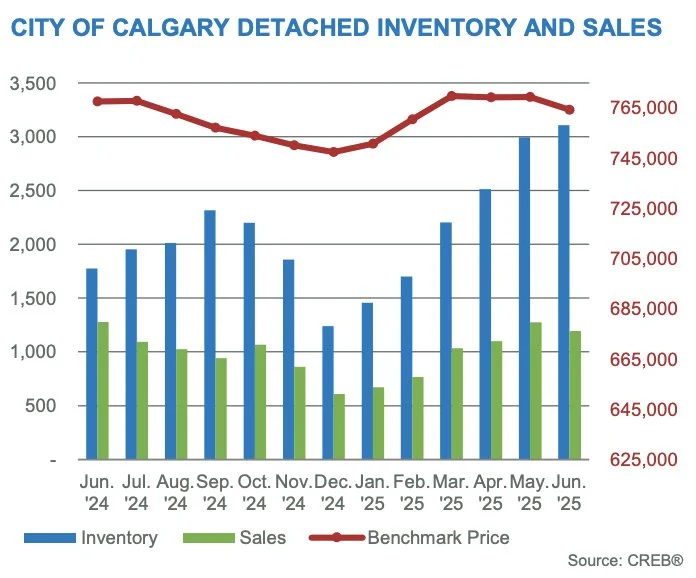

Almost all housing types, styles and areas within the city of Calgary are seeing inventory increases with slight downward pressure on price. This month, I am showing stats for the various regions within the city. The previous booms of 2007 and 2014 are good pieces of history to reflect on as we see the market shifting in our region. The big difference thus far in this shift is that the price of oil remains relatively high. Real estate values in our province most often track with the price of oil over time. Net migration to our province is down (still positive but nowhere near as high as the past few years). Layoffs in the construction industry lead the province in total layoffs for July (17,000+). New build sales are down with many builders offering incentives just to get you to come to their show homes. Wow, what 6 months can do. However, not all is lost. We had an over heated market and now we have a more balanced one and in some product categories, a buyers market. Downward pressure on price is slight thus far. If you are buying and selling in the same market, it is all relative. If you are planning to buy or sell over the next year, think longer term. There are many factors to consider when making your real estate decisions and I am here to help you with that. That is what I enjoy, helping people navigate life’s big decisions.

Okotoks peaked in July as did High River. These areas typically are a few months behind tracking with Calgary. Rural properties are seeing similar trends in inventory increases. Multiple offer situations are still occurring but it’s a small percentage of prime properties that warrant that level of interest.

Calgary and area real estate inventory continues to climb.

Inventory of homes for sale in the city of Calgary continues to grow moving most of the city into a more balanced market. Some properties are still entertaining multiple offers, but in general, it’s taking longer to sell a property. Expectations of a quick sale need to be tampered as buyers are taking a bit more time making a decision. Global events weigh heavy on peoples minds. However, the Foothills region remains highly desirable and we continue to see positive net migration. Calgary peaked in price early spring and is seeing some small downward pressures. Okotoks, and High River have remained strong but are likely peaking now as we enter the slower mid summer months.