A brief real estate market history recap: We had a big market bump between 2005 and 2007 when property values doubled. Then we had the “crash” of 2008 that bottomed out in 2011/12 with a 15-20% drop in values. Oil prices recovered and real estate again peaked in 2014 with slightly higher market values than 2007. Then it was the slow decline with ups and downs until early 2020 with an overall 8-10% correction downward. Covid hit and in the very early stages, the market froze. Then, real estate demand and prices took off which was a huge surprise to almost everyone: analysts, economists, city planners, real estate guru’s, and investors. The Covid years was a time of UPSIZING or renovating as many people switched to working from home, taught their kids from home and simply needed more space to do this. Acreage properties were the first to see huge demand as people wanted to get away from people. Apartment and condo sales plummeted. In 2021, detached home values started to go up. Apartment price growth truly started in 2023.

World events in the past three years meant the price of oil escalated considerably. The price of oil is one of the major indicators affecting Alberta’s real estate market. You can track the price graphs over time and see the effect Oil has on real estate values in our province. (see graphs below)

It’s hard to say what is going to happen to real estate values going forward other than right now, we have a shortage of inventory largely due to a shortfall in new housing starts and the fact we have good net migration of people moving into the area. And that my friends is another whole conversation and a topic be to discussed in another segment of “How’s the Market”. There are lots of dynamics at play which each have numerous underlying components. In my opinion, there are 4 major influencers on overall market health for real estate in our region; Housing Starts, Net migration, Price of Oil, Interest Rates. Given current market conditions and the state of these 4 influencers, I see us having a pretty good run until late summer/early fall 2024 and then after that my crystal ball gets very hazy as we approach the end of 2024 and into the spring of 2025.

We live in very fluid times. One thing about real estate, if you are buying and selling in the same market, it is generally all relative. However, the lower to mid price points have seen the most gain in price over the past 3 years and thus, if a person can afford it, selling and doing a move up may result in more net gain in value over time.

Current Market: Okotoks and Calgary have a shortage of inventory in the under $1mil range.

Okotoks: March 12th. We have a total of 41 properties for sale made up of 29 detached homes, 3 apartments, and 9 townhouses or duplexes. There are only 2 houses for sale under $600,000. That’s it! In a more balanced market, we would have a 120+ properties. During down markets, we would be pushing 200+ homes for the early spring market. Sales are strong and there are far more buyers than sellers. High River and Diamond Valley are seeing strong demand for homes and condo’s as well.

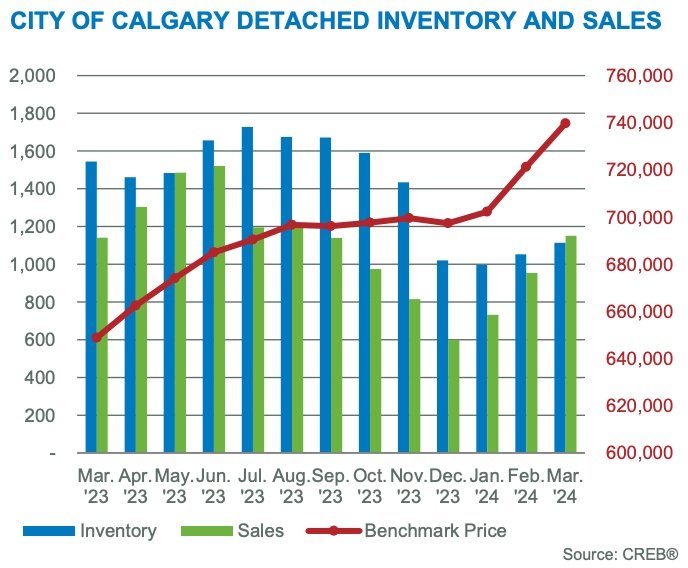

In all of Calgary, there are only 788 detached homes for sale, 33% of which are priced over $1million. (526 homes for sale under $1,000,000). In Feb 2024, there were 836 sales under $1mil which is about half the number that sold in 2022. Only 93 homes for sale are priced under $600,000 in all of Calgary, a city of 1,400,000 people! Affordability is a huge issue for many and why townhomes and apartment sales have been going up considerably in price and also why the majority of the new build construction is in this product class. There are 967 apartments and townhomes/duplexes for sale and in Feb 2024, there were 1,181 sales. Until new construction and permits to build catch up with overall demand, we will see a supply crunch. Builders/developers are full steam ahead as we speak.

Foothills County: Rural property sales have certainly slowed down this year thus far after the boom covid years. 55 Acreage homes are for sale right now in the very early spring market and we should expect this number to grow come April/May/June. 40 of the properties for sale are priced in excess of $1.4 million. 6 sold over that price point in Feb 2024. There is very little inventory under $1.4 million. For bare land, there are 36 acreage lots for sale under 5 acres with only 3 sales in Feb. There are 33 pieces of land over 5 acres with 2 sales in Feb. I doubt we will see much in the way of price growth in acreage properties this year. The hot ticket properties remain under $1million as there are only 6 for sale in the whole county. Rockyview County tells a similar story. There are more in the upper end acreage estate homes in Rockyview and more sales over $1.4 mil. 102 are for sale priced over $1.4 mil with 18 sales in Feb. It will be interesting to see how the Rockyview upper end market does in 2024. It is a bit of a bell weather for confidence in our economy along with the $1mil plus market in Calgary.

Going forward: If you are curious about what’s your home worth today, send me a text, email or give me a call - no pressure. If you are thinking of renovations and want an opinion or to simply chat about ideas feel free to contact me as that’s a super fun part of what I do. If you have friends, family, or acquaintances thinking of buying or selling please send them my way as referrals are a huge part of my business and are always greatly appreciated!